This new FHA wishing months shortly after bankruptcy and you will foreclosures begins in the registered go out or the date of your sheriff’s foreclosures business and you will deed-in-lieu away from foreclosure. Also, you will find a beneficial around three-12 months wishing period on small selling time and you may from the go out of a mortgage fees-of or next financial fees-over to be eligible for FHA home loans. Loan providers including worry the necessity of to stop later money after a beneficial foreclosures, deed-in-lieu away from property foreclosure, or quick selling.

Its a common misconception you to an earlier bankruptcy, foreclosure, deed-in-lieu off foreclosures, otherwise brief purchases often trigger higher home loan prices, for example off FHA money. Alex Carlucci, an elderly financing officer and you will people chief from the Gustan Cho Lovers, describes the newest feeling of those events toward home loan costs, particularly bringing up the newest FHA prepared several months after personal bankruptcy and you can foreclosure:

In comparison to faith, a case of bankruptcy otherwise foreclosure doesn’t impact the cost out of home loan cost on FHA fund, neither were there financing-level pricing adjustments considering these incidents to possess FHA loans.

Fico scores are definitely the top determinant out of financial prices getting FHA financing. In contrast, antique loans believe fico scores and you may mortgage-to-worthy of rates to own price commitment. Previous personal bankruptcy or foreclosures does not affect the interest levels borrowers found for the FHA prepared several months shortly after bankruptcy proceeding and foreclosures. There aren’t any cost alterations for those situations towards the FHA mortgage pricing.

Which are the Advantages of an FHA Loan?

While the a good example, once a part 7 bankruptcy proceeding launch, you can be eligible for a keen FHA financing within couple of years, and you may just after a property foreclosure, you happen to be eligible for the 36 months. So much more flexible underwriting assistance: The latest FHA has actually significantly more easy underwriting requirements than just antique loan providers payday loans without bank account in Gilcrest and you will can get imagine compensating activities such as your a job history, discounts, supplies, or fee records when researching the loan app.

Exactly what are the Disadvantages away from a keen FHA Mortgage?

A keen FHA financing even offers certain drawbacks you have to know ahead of using. Any of these downsides is actually High mortgage insurance costs: You’re going to have to pay one another an initial and a yearly financial cost getting an enthusiastic FHA loan, that can enhance your monthly premiums and settlement costs.

You are going to need to afford the annual MIP to your life of your financing or perhaps 11 many years, dependent on the downpayment and you can financing name, whereas you could terminate the personal financial insurance coverage (PMI) to own a conventional loan after you attained 20% guarantee in your home.

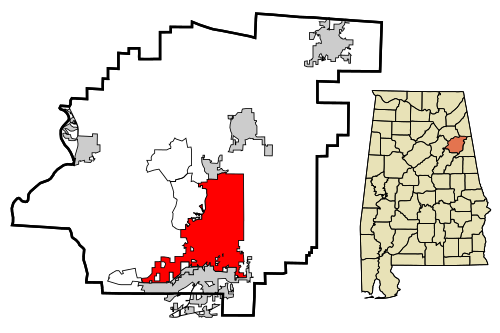

FHA finance enjoys all the way down loan constraints than simply conventional funds. The amount you can borrow having a keen FHA loan is actually topic to restrictions put by FHA, and that differ depending on the county and kind out of property. Because of this, in a number of parts, you may find it hard to buy a very high priced house using an enthusiastic FHA financing.

HUD Possessions Conditions To possess FHA Loans

Possessions standing standards towards FHA financing are the assets needs to feel safe, habitable, and you can safer. HUD provides rigid criteria with the reputation and quality of the assets we should pick with an enthusiastic FHA loan. The house need to meet with the minimum possessions conditions (MPRs) and you may pass an appraisal by the a keen FHA-approved appraiser.

The new MPRs shelter certain aspects of the property, for example protection, protection, soundness, and you may cleanliness. Whether your possessions doesn’t meet with the MPRs, you may need to inquire owner and then make solutions otherwise play with a great 203(k) mortgage to finance the brand new repairs.

Antique Rather than FHA Waiting Several months Immediately after Bankruptcy and you will Foreclosure

An FHA loan makes you qualify for a mortgage at some point sufficient reason for smaller strict standards than just a traditional financing. Here are some types of how an FHA financing may help you buy a house immediately following different credit events. An enthusiastic FHA financing has several advantages for borrowers having a credit knowledge or other challenges during the qualifying having a traditional mortgage.