To remove loans in Moores Mill for people with bad credit some body out-of a home loan as opposed to refinancing, possibilities include a loan presumption where in actuality the left debtor takes full responsibility, otherwise getting bank approval to change the borrowed funds and remove the new man or woman’s label, tend to for the divorce cases.

When you have home financing with good conditions however, need to change that is titled inside, you can search for answers based on how to remove anybody out of a mortgage in place of refinancing. The great information are, you may have options, although best choice are very different predicated on your unique activities. Learn the an easy way to focus on your own lender to alter the fresh new someone titled on the financial.

- Would you Get rid of A person’s Name From a home loan Instead of Refinancing?

- Five Ways to Eradicate Someone Out-of a mortgage Instead of Refinancing

- step 1. Safe Approval Throughout the Financial

- Select All the fifteen Items

Do you Reduce Another person’s Identity Off a home loan Rather than Refinancing?

There are various issues in which anyone seek out reduce yet another personal of a mortgage, and divorce or separation, an effective co-signer attempting to go off after you’ve centered your own borrowing, etc. Based your loan’s terms and rates, refinancing was unsightly. You can end up getting a higher rate and you may save money along side loan term.

Homeowners and you can co-signers can reduce their names of home loan agreements without the need to help you re-finance otherwise boost the amount borrowed.

You’ll start by examining the choices. Such differ predicated on your position, particularly whether or not among entitled anybody wants to guess the borrowed funds.

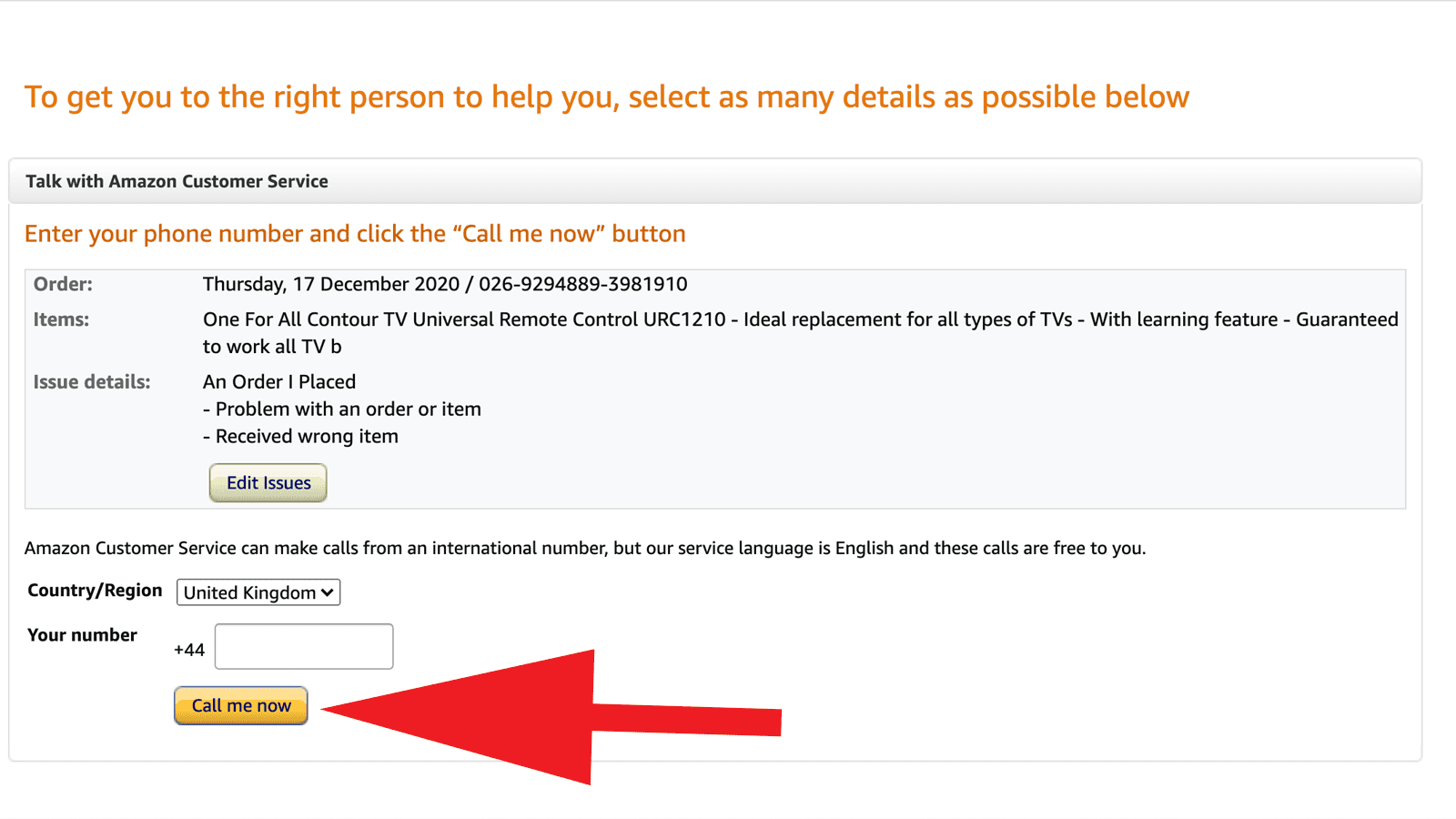

Then you’ll definitely speak to your bank to see what they provide in terms of switching the brands on financing. You want the lender to help you commit to the latest conditions that you will be requesting.

While you are not refinancing, there will be big records inside it. You will have to over which documentation to complete the loan amendment and make certain the other people has stopped being titled toward insurance rates otherwise taxation to have an entirely effortless procedure.

Four An easy way to Clean out Someone Away from a mortgage Instead Refinancing

Discover the choices having adjusting your mortgage to eliminate another individual of it. We have found a peek at five way of finishing this action.

step one. Safer Acceptance Regarding Lender

Your financial is lose a reputation out-of home financing rather than refinancing. The tough spend the this will be, it’s entirely around the lender to choose whether or not to ensure it is it. The trouble would be the fact lenders aren’t encouraged to provide loan amendment as less anyone listed on that loan form a lot fewer people commit immediately after to gather fund is to some thing go wrong.

A benefit to this package is that it is prompt and you may simple should your financial approves it. A downside would be the fact you can easily still be dealing with financial analysis observe if you can assume the borrowed funds oneself and also the required earnings to do this.

A lot of people choose this when they have done a breakup and then have a divorce decree that shows this new office from possessions. The lender knows it is impossible they keep each party on loan but you’ll still have to read economic critiques.

dos. Modify the Mortgage

Some loan providers are prepared to alter the real estate loan terms versus an excellent refinance. The best fool around with instances to have mortgage modifications is altering notice prices otherwise extending the new fees months. These two items helps make the borrowed funds less costly.

But in order to qualify for such adjustment, your normally have to prove a financial hardship. Particular lenders you will believe a divorce proceedings otherwise judge break up once the a beneficial pecuniary hardship. Simply talk to your home loan company to see if this might be a choice.