Aly Yale was a freelance publisher with more than ten years of experience level a house and private fund topics.

- 12-month repaired introductory speed to possess licensed borrowers

- $0 app, origination, and you will appraisal charges

- $0 closing costs

- Move particular otherwise all your valuable HELOC for the a predetermined-rate mortgage free-of-charge

- Closure usually takes half dozen in order to ten days, on average

Bethpage Federal Borrowing Partnership is a financial institution headquartered from inside the Long Island, New york. It’s several properties, along with financial, financial financing, capital features, and you can home guarantee lines of credit.

The credit connection possess more than 30 metropolises along the Tri-State town, although it properties users regarding the nation. If you’re considering using Bethpage to own a HELOC, here’s what you must know.

Bethpage even offers a good HELOC that enables one change your own residence’s guarantee for the bucks. You are able to funds from Bethpage’s HELOC your purpose, in addition to house renovations, merging financial obligation, otherwise purchasing college tuition.

The new HELOC are Bethpage’s only home security device. It generally does not promote a separate house security financing, though it lets transforming some otherwise all your valuable HELOC to the a fixed-speed loan, like a house collateral mortgage.

Positives and negatives regarding a beneficial Bethpage HELOC

As with any financial, dealing with Bethpage keeps pros and cons. Definitely envision each party of your coin before carefully deciding should it be a good fit for your home equity requires.

If you’re looking to possess a lender to help with almost every other issue of your own monetary lifetime, Bethpage’s of numerous qualities might help.

Bethpage’s HELOCs do not have app, origination, otherwise assessment fees. The financing union and additionally pays every settlement costs to have loan number around $five-hundred,000.

If you are not sure Bethpage FCU is a great complement your own HELOC needs, believe most other associations. Listed below are some our guide to the best HELOC lenders to get more guidance.

What do Bethpage’s users say towards business?

Consumer feedback and you will product reviews is critical when determining what financial to help you play with. Capable provide understanding of good company’s service and feature you what to anticipate given that a person.

Bethpage has experienced enough reviews that are positive recently, which you’ll pick to the Trustpilot, but keeps a terrible rating to your Bbb. Of numerous mention much time keep moments, contradictory recommendations regarding teams, and trouble with applications. The financing union as well as got 24 complaints on Most useful Company Bureau within the last 1 year.

Positive views of buyers recommendations comes with: friendly group, helpful loan officers, and you will a welcoming in the-people environment. Some recent evaluations feature self-confident opinions toward HELOC techniques having Bethpage, claiming I got an entirely easy experience from the start toward closing regarding my personal HELOC.

Would We be eligible for good HELOC of Bethpage?

- Credit score

- A career

- Income

- House really worth

Which have a traditional HELOC (otherwise one domestic collateral device), the greater number of valuable you reside while the decrease your financial harmony, the greater you can borrow.

The credit union isn’t particular on which assets products it permits you to definitely borrow on, although it does not thing HELOCs or mortgage loans to the functions for the Colorado.

Bethpage is obvious from the its membership requirement: To track down good HELOC regarding the establishment, borrowers need getting members of Bethpage FCU by the starting an economy membership with a minimum of $5.

How to incorporate with Bethpage?

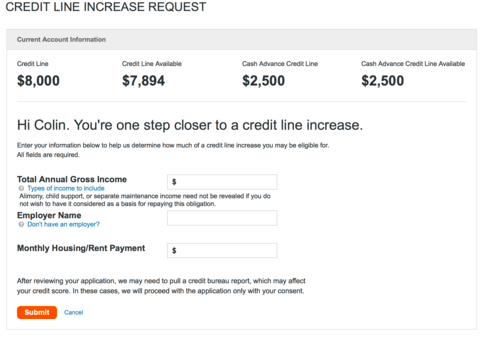

If you undertake the internet application solution, you can easily submit info regarding the home, your financial equilibrium, the objective of the borrowed funds, additionally the count you want. You will additionally become facts about their work, earnings, and you may intended co-applicant.

Shortly after they obtains the application, you happen to be conditionally recognized, and you may a lending expert tend to get in touch with disperse the process together. Dependent on your loan-to-really worth amount, loan size, and you can area, you need an appraisal.

Why does Bethpage decide how far I can obtain?

The most significant cause for how much you can obtain was the fresh new lender’s restrict financing-to-worth (LTV) ratio, hence stipulates how much cash of your own residence’s value your loan stability can take right up.

Getting Bethpage’s basic price, the most LTV was 75%, so that your HELOC and you will home loan equilibrium (combined) can’t equal more than 75% of the house’s most recent value.

To determine your own limit you are able to HELOC of Bethpage, you’ll deduct the a fantastic mortgage ($210,000) throughout the max LTV ($337,500) to obtain $127,five-hundred.

Remember: Bethpage will consider carefully your credit score, debt-to-income proportion, or any other criteria whenever choosing how much you could acquire, and that means you ount.

What does the newest assessment procedure appear to be?

Appraisals is actually a familiar an element of the home credit procedure. They offer lenders an impartial imagine out-of a great home’s worthy of, that they can then used to know very well what amount borrowed try suitable.

Centered on Bethpage’s HELOC FAQ, should your house is outside Much time Isle, appraisals are required to confirm their ily features-actually those in Much time Island-require also appraisals. An enthusiastic AVM (Automatic Valuation Model) could be drawn on line amounts up to $400,000 when the certified.

During this processes, a 3rd-team appraiser commonly look at their residence’s reputation, contrast it to other qualities in your neighborhood, and employ industry investigation to determine what it may get when you look at the the present day sector. Up coming Bethpage use so it amount-the appraised well worth-to decide just how much you could potentially acquire from your home security.

Appraisals are in of many variations. They’ve been done in individual, via push-by the, or using assets suggestions and online analysis. Bethpage will establish which type of appraisal is perfect for your property.

One of the biggest perks of a good Bethpage Federal Borrowing Connection home security range isn’t any application, origination, otherwise appraisal fees. You will never bear closing costs for financing number not as much as $500,000 Elmore loans.

not, borrowers are responsible for deposit $5 for the a checking account to become members of Bethpage in advance of closure to their financing.

Do Bethpage possess a customer service team?

To keep all of our 100 % free service to own consumers, LendEDU possibly obtains payment when clients mouse click in order to, submit an application for, or buy products appeared into sitepensation get perception where & just how businesses show up on the website. On top of that, all of our writers do not always comment every single business in just about any industry.